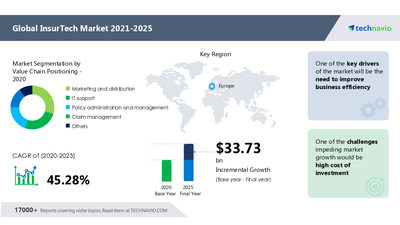

NEW YORK, Feb. 1, 2022 /PRNewswire/ — The InsurTech market is estimated to grow by USD 33.73 billion from 2020 to 2025, and the market’s growth is anticipated to accelerate at a CAGR of 45.29%.

Factors such as the need to improve business efficiency is significantly driving the InsurTech market.

Our research report on “InsurTech market – Forecast and Analysis Report 2021-2025” has extensively covered factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the market during the forecast period.

InsurTech market report key highlights

- Estimated year-on-year growth rate: 40.26%

- Key market segments: Value chain positioning (marketing and distribution, IT support, policy administration and management, claim management, and others), and Geography (North America, APAC, Europe, South America, and MEA)

- Key Consumer Region & contribution: Europe at 47%

|

InsurTech Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 45.28% |

|

Market growth 2021-2025 |

$ 33.73 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

40.26 |

|

Regional analysis |

North America, Europe, APAC, MEA, and South America |

|

Performing market contribution |

Europe at 47% |

|

Key consumer countries |

US, UK, France, Japan, and China |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alan SA, Clover Health, Cytora Ltd., Haven Life Insurance Agency LLC, Oscar Insurance Corp., Quantemplate Technologies Inc., Shift Technology, simplesurance GmbH, Trov Insurance Solutions LLC, and ZhongAn Online Property Insurance Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Do reach out to our analysts for more customized reports as per needs. Speak to our Analyst now!

InsurTech market trend

- Collaborations of investors

The collaboration of investors with InsurTech firms is one of the key factors fueling the InsurTech market share growth. This is due to investors showing an increased interest in collaborating with InsurTech firms or technology-first start-ups. Moreover, the involvement of technology has resulted in the transformation of the entire value chain of insurance including the costing process, improving the consumer experience, process transparency, reducing fraud, and simplification of the claim process for customers. In addition, the focus of InsurTech vendors is on the growing demands of consumers for the customization of insurance products and personalized services. As a result, there is a rapid increase in the importance of InsurTech among the insurance companies due to the growing trend of purchasing insurance over an application worldwide.

InsurTech market challenge

- High investment cost

The high investment cost is one of the key challenges for the InsurTech market during the forecast period. To sell insurance products using the latest technology is a new challenge for insurance firms as the employees are required to be provided with a good amount of specialized training on the technology used. Additionally, retraining is also needed for understanding the insurance product more in-depth to meet the needs of the clients. Thus, there is a huge investment required to be done by the insurance firms for hiring trainers for brokers and staff.

Get free sample for extensive insights on key market Drivers, Trends, and Challenges influencing the InsurTech market.

Key market vendors insights

The InsurTech market is fragmented, and the vendors are deploying various organic and inorganic strategies to compete in the market.

Some of the key market vendors are:

- Alan SA

- Clover Health

- Cytora Ltd.

- Haven Life Insurance Agency LLC

- Oscar Insurance Corp.

- Quantemplate Technologies Inc.

- Shift Technology

- simplesurance GmbH

- Trov Insurance Solutions LLC

- ZhongAn Online Property Insurance Co. Ltd.

For more detailed highlights on products offerings and the growth strategies adopted by other vendors, Download free sample report

- Key Segment Analysis by Value chain positioning

- Marketing and distribution

The marketing and distribution segment will be significant in the InsurTech market share growth during the forecast period. The increasing use of smartphones and the ease-of-access of the Internet through smartphones have bolstered digital marketing and digital distribution of insurance policies through advanced technologies. Moreover, the mobile point-of-sales in the e-retail business is increasingly being accepted. This is helping insurance firms in finding significant opportunities to address a large number of customers.

- IT support

- Policy administration and management

- Claim management

- Other

Regional Market Analysis

Europe will contribute to 47% of the global InsurTech market share growth during the forecast period. UK and France are the major markets for InsurTech in Europe.

The market growth in this region will be faster than the growth of the market in North America and MEA regions.

Request our free sample for additional highlights and key segments that are expected to impact the market during the forecast period.

Related Reports:-

Procurement Analytics Market – The procurement analytics market size has the potential to grow by USD 2.30 billion from 2020 to 2025, but the market’s growth momentum will decelerate at a CAGR of 15.62%. Download Exclusive Free Sample Report

Translation Management Software Market – The translation management software market size has the potential to grow by USD 1.58 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 14.81%. Download Exclusive Free Sample Report

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/insuretech-market-to-register-a-growth-of-usd-33-73-billion-at-a-cagr-of-45-28–improvement-in-business-efficiency-is-a-key-driver–technavio-301471528.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/insuretech-market-to-register-a-growth-of-usd-33-73-billion-at-a-cagr-of-45-28–improvement-in-business-efficiency-is-a-key-driver–technavio-301471528.html

SOURCE Technavio